Are you underestimating your labor costs?

Incorrect labor cost math is the hidden cost that's eating into your profits.

- Learn why your labor costs are actually 20-30% higher than what you're bidding.

- Get the exact formulas top contractors use to calculate true labor burden rates

- See how to properly allocate indirect costs across jobs to maximize profitability

"We were winning jobs but missing out on profits. Turned out we were lowballing every bid without realizing it."

- Larry, a (fictional but familiar) CFO at T-Rex Roofing

%20(1).png)

Fully-Burdened Labor Costs 101

Download your free ebook

Mauris commodo turpis elit, sed dictum orci pharetra ac.

Fully burdened, without the burden.

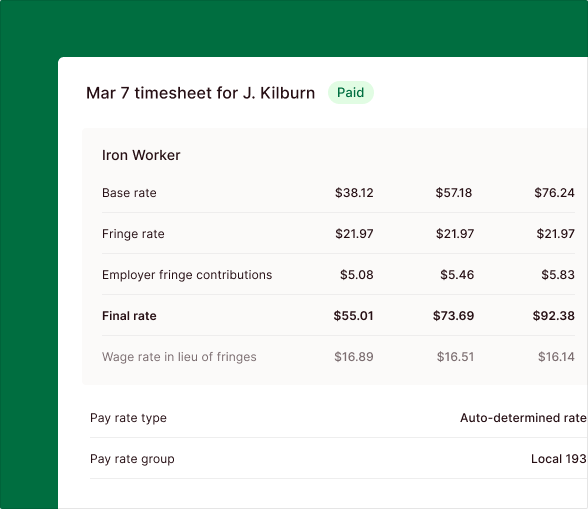

Miter helps you control how every cent of your labor costs - direct and indirect - show up on your P&L, your GL, and your WIP.

- Automatically allocate indirect labor costs.

Payroll taxes, worker's comp, benefits... allocate actual spend across your entire workforce to the right job, department, or cost code. - Allocate salary job costs.

Account for salaried employee job costs by enabling them to enter timesheets or by configuring allocation rules. - Dynamic burden rates.

Where needed, configure different burden rates for different employee groups and jobs.